We had bought SKS Microfinance on 16 Feb 16 at an entry price of 530.

This was bought as the stock had started getting into the formation of higher top higher bottom on daily time frame.

Also on monthly time frame the stock was about to breakout of rounding bottom formation.

Here is an article I had written on SKS Microfinance on 25th April.

This was bought as the stock had started getting into the formation of higher top higher bottom on daily time frame.

Also on monthly time frame the stock was about to breakout of rounding bottom formation.

Here is an article I had written on SKS Microfinance on 25th April.

SKS Microfinance - Potential to move 100% in one year

Though, the stock has lot of steam still left and can further move up from here, I have exited from my portfolio of Prime Cash as my objective is met. My portfolio is basically a short to medium term portfolio and is run for quick gains in stocks.

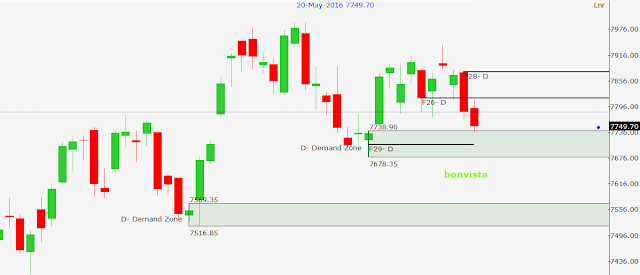

I have exited the stock at current level as there is a larger time frame resistance at current level. This zone is between 620-730. I feel stock will consolidate at current level before starting a further up move.

Hence I have exited at a price of 635 on 30 May with the gains of 19.8%.

Here is a snap shot of complete trade from my Portfolio Advisory System which is accessed by my paid subscribers.

There is lot of debate on whether Technical Analysis really works, This is how I would put it. Its not only about Technical Analysis (or any other analysis for that matter) to make money in stock markets. There are so many other factors which are responsible for one to make or loose money. For example a portfolio framework, trading / investing discipline etc. The whole basket decides whether you will make money or not.

I run this Model Portfolio Prime Cash for retail investors /traders in Indian stock markets. This portfolio has been dong well consistently.